On September 8, the School of Business and Management at SISU invited Mr. Zheng Ke, a Management Practice Professor in the MBA program and Deputy General Manager of Shanghai North Bund (Group) Co., Ltd., to share his valuable insights into the concepts of carbon peaking, carbon neutrality, and the green financial opportunities they present.

Mr. Zheng began by presenting the trends and dangers of climate change using several sets of data. Climate change has become a global crisis facing humankind. The increase in carbon and other greenhouse gas emissions poses a threat to life on earth. In this context, nations worldwide are striving to reduce greenhouse gas emissions through global agreements. Consequently, China has proposed the goals of carbon peaking and carbon neutrality.

He then elaborated on the concepts of carbon peaking and carbon neutrality, as well as China’s progress in reducing carbon emissions in key sectors. Mr. Zheng highlighted two primary approaches to achieving these objectives. First is a strengthened regulation, namely, stricter governmental oversight of high-emission industries. Second is “privatization,” which involves pricing carbon emissions and integrating them into the market for trading purposes. This “carbon trading” mechanism allows for the redistribution of government-defined carbon emission quotas among enterprises. When businesses exhaust their allotted credits, they have the option to purchase additional credits from the market, effectively leaving carbon pricing to market forces. Consequently, companies are compelled to factor in carbon emissions as they are tied to their operating costs.

China will strive to peak its carbon emissions by 2030 and achieve carbon neutrality by 2060. Mr. Zheng emphasized the necessity of China’s green strategy in safeguarding international relations, enhancing energy security, reshaping the global competitive landscape, promoting new economic dynamics, creating job opportunities, and driving development in the west.

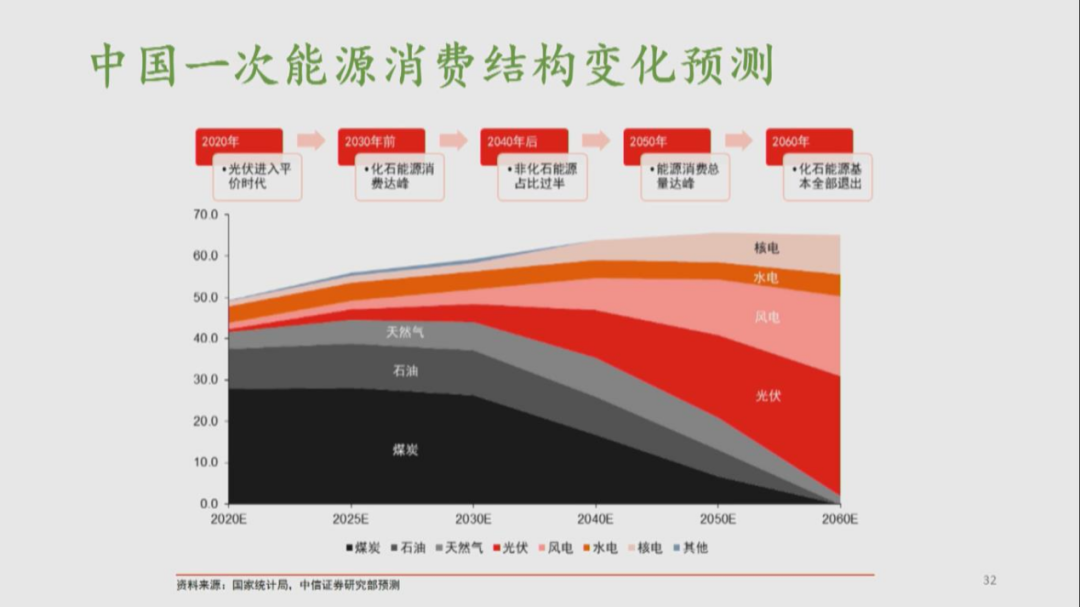

Furthermore, Mr. Zheng presented a forecast of changes in China’s energy structure, wherein non-oil energy sources would comprise more than half of the total after 2020. Fossil fuels are projected to be gradually replaced by new energy sources such as photovoltaic, wind power, and hydropower by 2060.

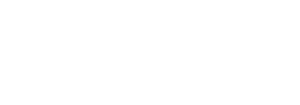

In this context, the People’s Bank of China, along with the Ministry of Finance and six other ministries and commissions, jointly issued the Guiding Opinions on Building a Green Financial System. The term “green finance” refers to economic activities aimed at improving the environment, addressing climate change, and using resources efficiently. In other words, it encompasses financial services for project investment, financing, project operation, and risk management in fields such as environmental protection, energy conservation, clean energy, green transportation, and green building. Mr. Zheng then explained the distinction between green finance and the traditional green economy. The traditional green economy relied on fiscal means, where green industries and products received subsidies and tax reductions, while non-green industries and products faced additional taxes. In contrast, green finance adopts financial measures. For example, financial institutions support financing for green industries, and governments introduce preferential financial policies for cleaning industries.

Finally, Mr. Zheng explained the construction of China's carbon market, carbon trading, and its outlook. The students found this lecture highly informative and insightful. During the Q&A session, when asked about the practical significance of these trends for individuals, Mr. Zheng responded, “Currently, carbon trading primarily involves high-emission enterprises, with institutional investors and individuals not yet allowed to participate. However, for students who can grasp these trends, this sector holds promising opportunities for future employment and entrepreneurship.”

The lecture ended with continuous applause from the audience. Students exchanged ideas and feelings with the Mr. Zheng proactively. This lecture significantly enhanced students' comprehension of the current trend, national policies, cutting-edge technological concepts, which will be highly beneficial in their work and studies.